Challenges & Opportunities 2021 after Covid

November 20, 2020

2020 comes to an end finally. Believe or not, this Covid has been with us for almost a year. I must praise everyone who is reading this article, you have done an excellent job fighting with this pandemic. On Nov 9th, Pfizer and BioNTech surprised the world by announcing that the preliminary results of the Phase 3 clinical trial of their coronavirus vaccine showed 90 per cent effective. It is Hope.

Dr Sahin, co-found of BioNTech, anticipates that our life will go back to “normal” in the winter of 2021. However, the effects of COVID19 have swept the world disrupting daily life in countless ways for better or for worse. no matter where you located or what job you do, many aspects have changed or re-shaped, and would not go back to the way they were.

JUMP:Growth in e-commerce has increased significantly

Growth in e-commerce has increased significantly since the start of the pandemic. Statistics Canada says e-commerce sales hit a record of $3.9 B in May, a 2.3% increase over April and 99.3% increase over February.

Compared to May 2019, e-commerce sales doubled by 110.8%. Global E-commerce sales are expected to grow almost 20% annually and is projected to hit $4.9 trillion in 2021.

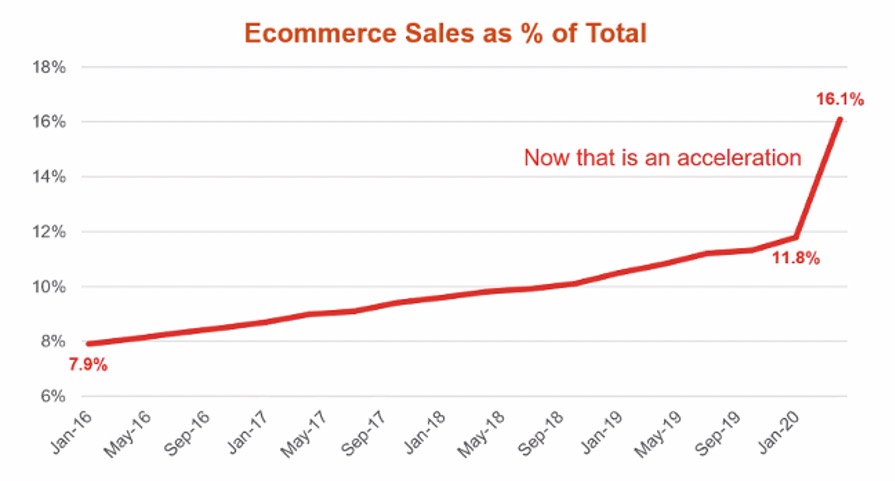

According to the data of PWC Emerge Trends in Real Estate 2021, the proportion of e-commerce in overall sales increase only 3% in last five years. However, it soared from 11.8% in January 2020 to 16.1% this month.

TRANSFORMATION: Merge of E-commerce and Store Buying

Walmart which keeps trying to expand its digital business has an advantage compare to Amazon and those pure online retailers, its vast base of large stores. John Crecelius, senior vice president of Walmart, posted on a blog said that Walmart has two test stores up and running with two more set to open in US.

This experiment will accelerate inventory movement from backroom to sales floor, speeding up in-store pick rates for online orders, and eventually find solutions that help its stores operate as both physical shopping destinations and online fulfillment centers in a way that has yet to be seen across the retail industry.

https://www.supplychaindive.com/news/walmart-new-test-stores-blend-tech-in-store-ops/588309/

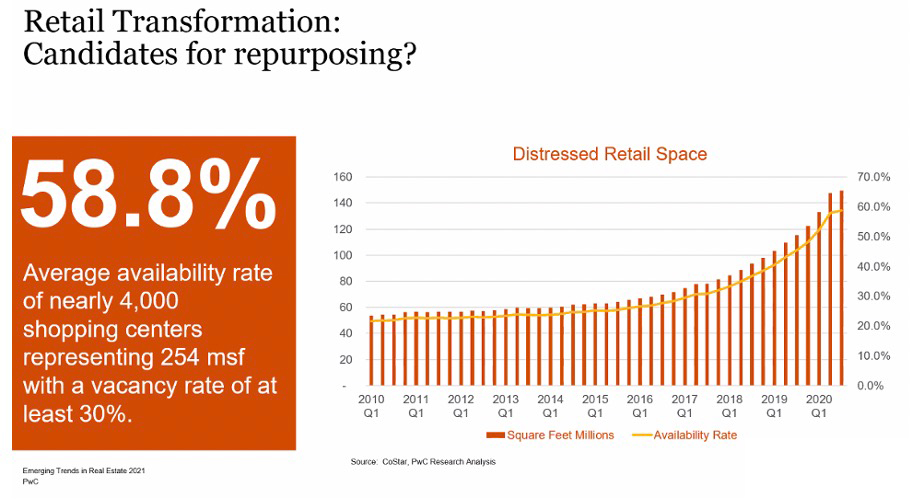

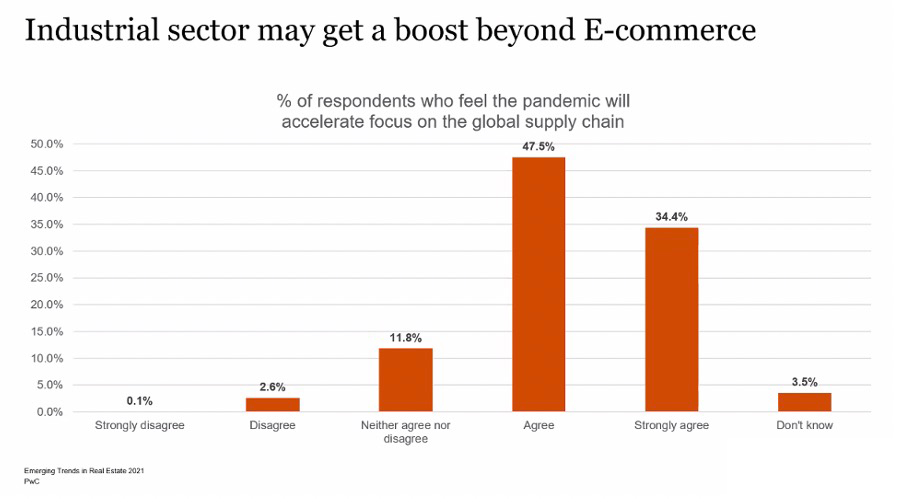

BOOST: Boom of Industrial Real Estate

E-commerce is forcing companies to keep larger and more diverse inventories in closer proximity to the end users. During the first half of 2020 when suppliers couldn’t fill local orders, helped illustrate urgency to having more inventory on hand to support local online sales. By the end of the year, there will be significant demand for leasing in the large e-commerce category of industrial buildings. Locally, even before the pandemic, Vancouver’s industrial demand was being driven in large part by last-mile logistics.

Online retailers like Amazon, Ikea, and Walmart bought or built about 2.4 M SF of industrial warehouse space across Metro Vancouver in 2019. The intensification of e-commerce and logistics services will continue to spur demand for industrial space even further. Consumer expectations for same-day or next-day goods are likely to keep growing, and the lack of well-positioned industrial space is placing a significant strain on various retailers and e-commerce giants that depend on a network of distribution centers.

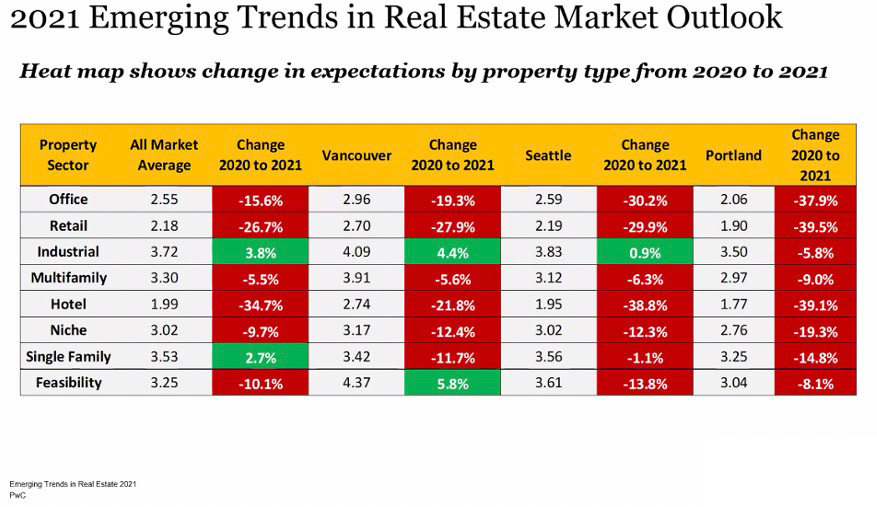

VOLATILITY: Trends in various Real Estate Sectors

BEHAVIOR: Attitude toward work from Home is changing

Statistics Canada reported that 4.7 million Canadians started working from home in March. During this pandemic, stay home work forces have been surprised by how quickly and effectively technologies for Zoom and other forms of digital collaboration were adopted. Most time, the results have been better than imagined. Many surveys have shown that people like the flexibility and not having to commute to the office. Companies have realized that productivity has not been hindered, and this will undoubtedly lead to a change in work practices.

REVOLUTION: PropTech Adoption Accelerated

Global investment in the PropTech sector has hit staggering levels totalling US $31.6 B in 2019, according to CREtech – a 227% increase from 2018.

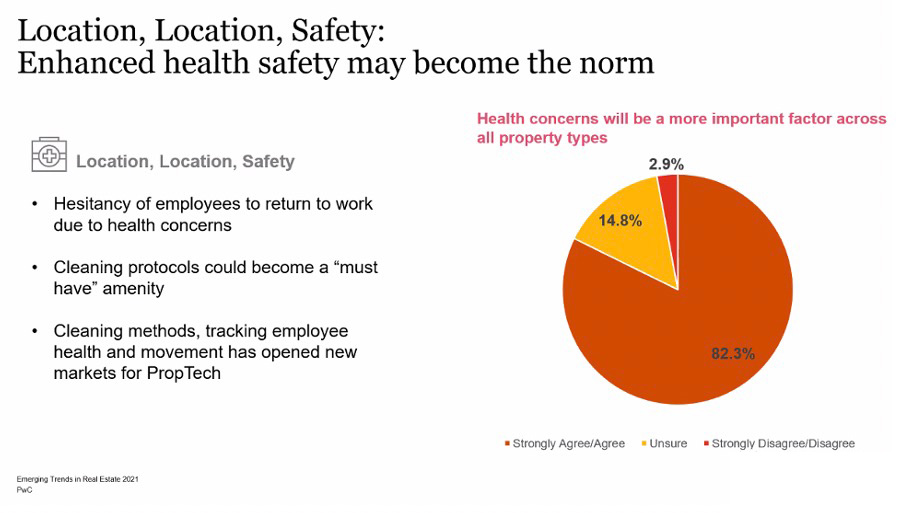

MetaProp’s survey found that 84% of PropTech start-up founders believe the coronavirus is accelerating the adoption of technology in the real estate industry. As workers return to their offices, landlords are implementing technology to enable touchless solutions, monitor common area occupancy and air control and to better communicate with their tenants.

A new report by independent European venture capital (VC) fund PropTech1 Ventures found that agile start-ups and those that address rapidly changing requirements and expectations induced by COVID-19 will prosper, emphasizing start-ups with technical solutions that reduce the risk of infection in office and retail space.

Source: Top 10 Real INSIGHTS in 2020 Vancouver Real Estate Forum by Altus Group

POLICY: Aggressive new immigration targets will be long-term boost for rental market

On October 30th, the Government of Canada announced its three-year plan to welcome 1.2 million immigrants between 2021 and 2023. If the targets are met, the immigration boost will compensate for the 2020s drastically reduced numbers that came as a result of application and travel constraints caused by the COVID-19 pandemic.

It is well-known that the growth in the housing market is predicated on population growth. It is less known that most new immigrants rent until they determine where they want to live, establish jobs and income, which qualify them for the credit to buy a property. On average, a newcomer purchases real estate three years after landing. A boost in immigration over the next three years could absorb rental inventory quickly, tightening the market back up and increasing average rents again.

ENTERTAINMENT: Go Online

Covid-19 has flattened some entertainment businesses and turbo-charged others. Disney is an example of both. Its resorts division, which last year accounted for the largest chunk of its revenue, has been hit by theme-park closures and docked cruise ships. Its movie business has been put on hold by cinema closures. And its cable channels have been hurt as ESPN, its sports brand has had fewer games to show.

The bright spot is video-streaming. Hulu, majority-owned by Disney, and Disney+ channel have made the most of a captive audience. Analysts forecast that by the year’s end, a third of American households that stream video will subscribe to Disney+. The service has an additional purpose: harvesting data on customers, to whom Disney can flog plastic lightsabers, Queen Elsa dresses, and holidays with Mickey Mouse when the pandemic has subsided. With a vaccine on the horizon, that fairy-tale ending is coming into sight.

POPULATION: Fewer babies next year

I bet you have not thought about this, this pandemic will likely cause the decline of birth rate. Some people playfully speculated that there would be a spike in births in nine months, as people had to “stay home” with their romantic partners, at the beginning of lock down. However, the pandemic is not simply a major electricity blackout, which is leading to tremendous economic loss, uncertainty, and insecurity.

Economic reasoning and past evidence suggest that this will lead people to have fewer children. Along with data presented from the Great Recession of 2007-2009 and the 1918 Spanish Flu, the decline in births could be on the order of 300,000 to 500,000 fewer births next year.

source:https://www.brookings.edu/research/half-a-million-fewer-children-the-coming-covid-baby-bust/

EMERGING MARKET

Swire, one of Hong Kong’s most famous colonial-era groups, was removed from the benchmark Hang Seng stock index. It was replaced by Meituan-Dianping, a Chinese food-delivery app, reflecting corporate Hong Kong’s shift towards the mainland. Swire’s businesses, including Cathay Pacific, have been hit hard by both the pandemic and upheaval in Hong Kong. Its shares have dropped by 35% this year.

Alibaba said it made sales of $70.6bn by the evening of the first day of its Singles’ Day shopping event, which this year will last four days. In spite of the positive news from the e-commerce giant, shares in many Chinese tech companies, including Alibaba, fell after regulators in China signaled plans to clamp down on anti-competitive behavior by fintech firms.